You see, real-time transaction monitoring is the cornerstone of payment fraud prevention. But let’s face it—scaling it has always been a challenge. That’s where CrateDB changes everything.

With its SQL-native design, CrateDB fits seamlessly into today’s operational systems—systems that are overwhelmingly SQL-based. It doesn’t stop there. CrateDB brings document flexibility, so it handles all kinds of data—structured or not—with ease.

Banks and financial institutions using CrateDB are transforming the way they work.

- Real-time and batch processing? No problem.

- Hundreds of rules running efficiently to catch anomalies? Done.

- Faster sanction searches and advanced analytics to stay ahead of fraud? Absolutely.

But here’s the real breakthrough: CrateDB powers AI and generative AI to not just detect fraud—it learns in real-time, evolves, and gets smarter with every interaction.

The result?

- Fraud detection and reporting that’s not just faster, but smarter and easier.

- Alerts are automated.

- Suspicious Activity Reports (SARs) are pre-filled.

Why It's Broken and How to Fix It

Let’s keep this simple. Fraud prevention is a mess right now, and here’s why.

The Business Side

- First, it’s expensive. Businesses are running outdated systems that cost a fortune and don’t work very well.

- Second, they’re inefficient. These systems spit out way too many false positives, annoying customers and damaging trust.

- Third, teams don’t talk to each other. Fraud detection and analytics are siloed, slowing everything down.

- Finally, it hurts customers. Delays and mistakes make people lose trust in the system—and in you.

The Technical Side

Now, here’s the technical stuff:

- Fraud detection needs to handle all sorts of data: logs, locations, user behavior, device info. But legacy systems can’t do that—they’re just not built for it.

- Fraud tactics are always changing. Static rules can’t keep up, so new fraud goes undetected.

- And scalability? These systems fall apart when the data gets big.

- On top of that, they don’t integrate with modern tools like AI or machine learning—the things we need to stay ahead of fraud.

Here’s the point: the current approach is broken because it’s built on outdated ideas. The fix isn’t complicated—it’s about designing systems that work with today’s data, today’s threats, and today’s tools. Once you see it, it’s obvious. Let’s start there.

How CrateDB Makes Fraud Prevention Smarter and Simpler

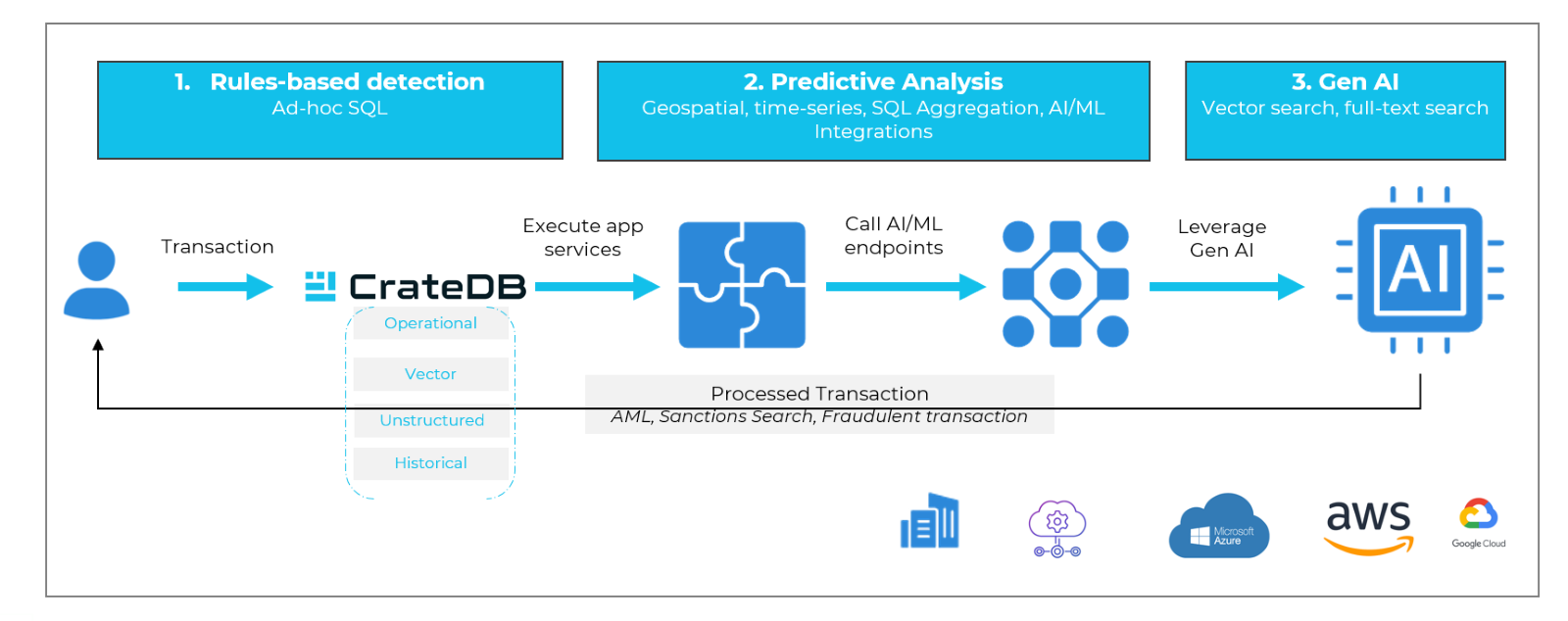

Let me explain how CrateDB tackles fraud prevention in a way that’s both powerful and straightforward.

1. Rules-based detection made simple with SQL

CrateDB lets fraud detection teams stick with what they already know—SQL. You don’t need to learn a new system or language. For example, if you want to flag large, unusual transactions, here’s all it takes:

SELECT transaction_id, amount, location FROM transactions WHERE amount > 10000 AND location NOT IN (SELECT known_locations FROM users);

It’s simple, clear, and familiar, but it does a lot of heavy lifting.

2. AI and Machine Learning Integration to Improve Detection Accuracy

CrateDB isn’t just about rules—it’s about possibilities. It works seamlessly with AI and machine learning platforms, integrating your predictive models, machine learning, and even generative AI. With powerful text-search and vector search, you can sift through domain-specific data like never before, training smarter models and creating prompts that make LLMs truly relevant.

The result? Fewer false positives, sharper fraud detection, and customer messaging so tailored, it feels personal. This isn’t just innovation, it’s transformation.

3. Real-Time Fraud Detection for Immediate Action

Fraud doesn’t wait, and neither does CrateDB. It’s built to process log and event data in real time, catching fraud the moment it happens. Take hybrid search, for example—sanctions and AML checks are faster than ever. Simple. Powerful. Effective. And with AI inferences activated in real time at millisecond latency, you’re not just keeping up—you’re staying ahead.

The result? No more guessing. Just precise, insightful fraud detection powered by a complete perspective. It’s not just better—it’s smarter.

Real-time Intelligent Fraud Prevention at Scale

Here are a few more reasons why CrateDB is the game-changer for building a sophisticated, real-time, event-driven fraud prevention and transaction monitoring system.

4. Unified view of Customer Activity

CrateDB isn’t just about collecting data—it’s about connecting it. With powerful data federation and rich connectors, it brings together diverse datasets—transactions, behaviors, locations—into one seamless, unified view. And it’s all possible thanks to its schema and document flexibility, which let you adapt to any data structure effortlessly.

5. Catches Fraud with Space and Time

Let’s simplify this. CrateDB gives banks and financial institutions the tools they need to build smarter fraud detection systems by combining geospatial and time-series analysis.

- With its geospatial features, CrateDB can help you spot unusual location-based activity. For example, it can flag when a transaction happens in two places at the same time—like New York and Tokyo. That’s a clear sign something’s wrong.

- Add time-series analysis, and you can track patterns over time. Say there’s a sudden burst of transactions at 3 a.m. when things are usually quiet. That’s another signal of potential fraud.

Using these powerful features, banks can build systems that don’t just detect fraud—they understand it. CrateDB makes it easy to catch fraud by letting you combine where and when things happen, all in one solution.

6. Handles Variable Payment Rail formats and Standards

Payment rails come in all shapes and standards—ISO 20022, PSD2, and more. From structured data and JSON logs to IoT streams, time series, and even advanced AI-ready formats like vectors, it’s a messy world. But CrateDB makes it seamless. Designed as a multi-model database, it effortlessly handles diverse data types, unifying and analyzing them across systems for precise fraud detection, all within a secure environment.

7. Scale Effortlessly with Transaction Volume

Big data? That’s not a problem, it’s an opportunity. CrateDB is built for scale, designed to handle massive volumes of transactional data with ease. It processes data quickly, reliably, and without breaking a sweat, so when your volumes grow, your performance doesn’t falter. With CrateDB, big data isn’t just manageable, it’s your advantage.

The Bottom Line

Fraud prevention systems need a rethink, and CrateDB is here to help build them. Scaling real-time transaction monitoring has always been a challenge, but CrateDB empowers banks and financial institutions to create unified, SQL-native platforms that handle diverse data effortlessly. With its schema, document flexibility and AI integration, CrateDB supports systems that evolve with patterns, detect threats faster, and provide actionable insights.

CrateDB isn’t the fraud solution—it’s the foundation for building smarter, faster, and scalable fraud prevention systems that keep institutions ahead of the game.